“

💡 Foreword: The Bank of Japan is no longer "playing dumb," and global markets are bracing for impact.

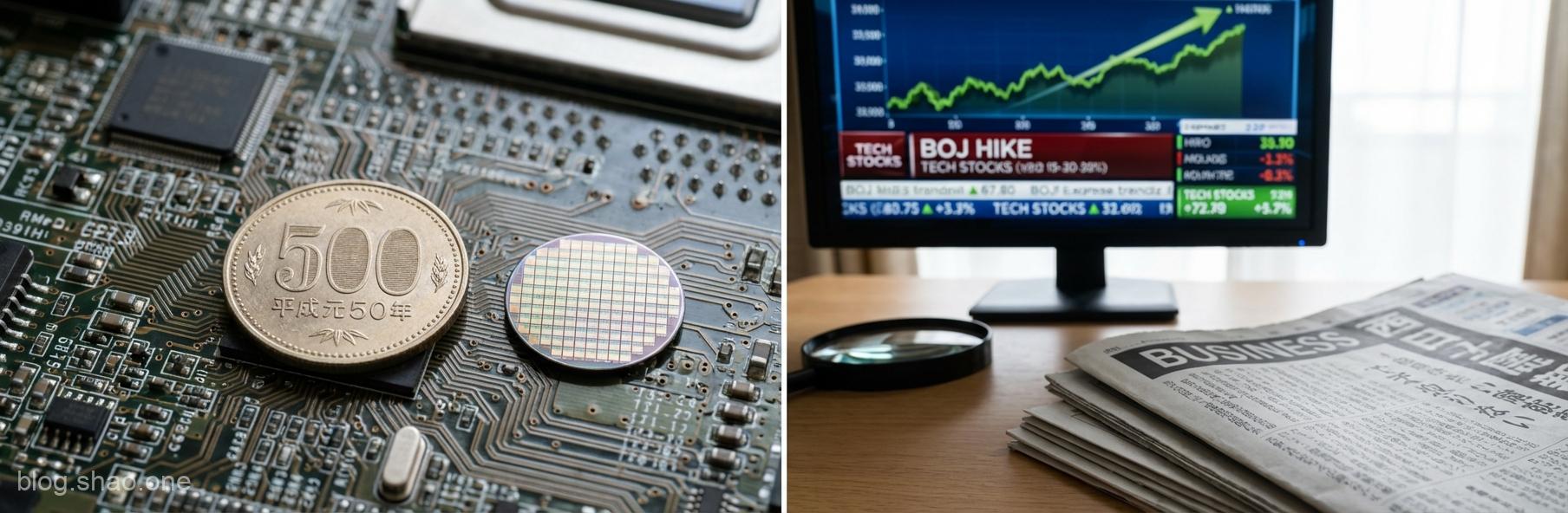

Just recently, global financial markets were rocked by an "epic" announcement that sent shockwaves across industries. The Bank of Japan formally raised its benchmark interest rate, pushing the yield on 10-year government bonds to its highest level since the 1990s. This marks not only a major turning point as Japan bids farewell to its long-standing "negative interest rate" environment, but also triggers a seismic economic shift for the global tech industry—a ripple effect with far-reaching consequences.As technology observers, we must look beyond surface figures and delve into how this unprecedented shift will impact our familiar sectors—semiconductors, consumer electronics, and AI investment strategies.

🏮 Japan's Interest Rate Hike: A Once-in-a-Generation Event

According to the Financial Times, the Bank of Japan's latest move can be described as swift and decisive.For the past three decades, Japan's economy has been mired in low growth and deflation. To stimulate the economy, the government has maintained near-zero or even negative interest rates. However, with rising global inflationary pressures and the persistent weakness of the yen, the Japanese government has finally decided to abandon its "outdated approach," opting to raise interest rates for the fourth consecutive time after many years. For investors, this undoubtedly signals the end of an era.

🚀 Why Should Tech Circles Care? Analyzing Three Core Impacts

Although this is financial news, for tech enthusiasts and industry insiders, it's absolutely a matter that "affects their wallets":

- The soaring costs of semiconductor equipment and materials:

- Japanese Tech Giants' Strategic Shuffle:

- SoftBank and the AI Investment Funding Chain:

Japan plays a pivotal role in the semiconductor supply chain, particularly in photoresist materials, wafer materials, and precision manufacturing equipment (such as Tokyo Electron and Nikon). Should the yen strengthen due to interest rate hikes, export prices for these precision components will rise accordingly. For giants like TSMC and Intel that rely on Japanese supply chains, cost control will face severe challenges, potentially leading torise accordingly.

Japanese giants like Sony and Nintendo have long benefited from low-interest loans to fund R&D and expansion. With interest rates now rising, these companies will inevitably become more cost-conscious when pursuing global acquisitions or large-scale technological development, potentially even adjusting their future product roadmaps. For gamers and consumers, this may signal uncertainty in the release pace or pricing of upcoming new devices.

SoftBank Group, led by Masayoshi Son, has long been a major financier of global tech startups. The company has heavily leveraged cheap yen borrowing to invest in AI and software companies worldwide. As Japanese interest rates rise, the cost of this "carry trade" will increase significantly. Should this vital funding stream diminish, the financing landscape for global AI startups could shift from a "blooming garden" to a "chilling effect."

🔍 Expert Commentary: Only by preparing for the future can one remain as steady as a mountain.

This interest rate hike in Japan serves as a stark reminder to all tech professionals: there's no such thing as a free lunch.The era of cheap, long-term funding has ended. The tech industry must now return to building solid profitability and technological innovation. I believe this isn't entirely bad news for the tech world. As the saying goes, "True gold fears no fire." In an environment of higher capital costs, only genuinely competitive technologies and products will emerge victorious through the market's rigorous testing.As a global technology hub, Taiwan shares an interdependent relationship with Japan's supply chain. Facing Japan's major economic transformation, domestic enterprises must proactively prepare by diversifying supply chains and managing exchange rate risks. Only then can they maintain competitive advantages amid this financial wave and avoid suffering a crushing defeat.

📅 Conclusion: Keep your eyes open and your ears alert.

Japan's interest rate hike is merely a microcosm of broader global economic restructuring. As tech enthusiasts, while we chase the latest foldable phones or AI models, we must also remember to "look up and watch the road"—keeping an eye on these macroeconomic shifts. For in this era of globalization, even a minor interest rate adjustment in Japan can trigger a butterfly effect, ultimately reshaping the very tech products we hold in our hands.We will continue to track the unfolding developments of this economic transformation in Japan. Stay tuned to ensure you always stay ahead of the curve in the tech wave!”

![[Tech & Public Health Observation] Shockwaves at the Top U.S. Epidemic Prevention Agency! NIAID Quietly Lowers the Flags of Pandemic and Biodefense – The Intentions Behind It Spark Concern 3 1771159633113](https://cdn.blog.shao.one/2026/02/1771159633113-768x251.jpg)